Table of Content

Stamp duty is an indirect tax levied by the state government on the purchase of the property. This could include an agreement to sale deed, power of attorney, conveyance deed, etc. All set to take up a home loan after due diligence and caparison of multiple quotes on interest rates and EMIs?

With a budget, it means the stamp duty, registration charges and downpayment should come within the savings you will have accumulated. But the term ‘budget’ here is not confined to such charges only. You will also need to compare interest rates and processing fees of different lenders and choose the deal that you can afford considering your income and repayment capacity. In the intervening time between the submission of the loan application and the bank approving of the same, the lender has to perform certain tasks to process your request. The bank officials will thoroughly check the veracity of your application and the documents attached with it. To carry out this task, the bank charges a processing fee from the buyer.

Late Payment Charges

The agreement may be registered with the sub-registrar’s office where the mortgaged property is situated. The procedure for the registration is the same as for the other documents. Prospective loan seekers many a time just use the interest rate as the basic yardstick to compare various home loan deals. The official website registration.telangana.gov.in can be utilised to book an online slot for Telangana Non-Agricultural Property Registration with a certain date and time. Non-agriculture property registration services are also available at Meeseva Centres for Rs. 200. Although each sub-registrar office is authorised 100 slots each day, only 24 slots are now available.

This also includes the annual charge for updating your home loan records. You can go and check with the bank if you wish to know MOD charges for home loan SBI or for any other bank in fact. In this case, the rules say that all the parties are liable to pay stamp duty, in proportion to their share in the property. When you do not pay stamp duty, the purchase or transaction cannot be accepted or received as evidence. In short, it is not valid and such transactions will be impounded by law and a penalty will also be imposed. Quite strange but you might need to pay to get the list of original documents submitted by you with the bank.

EMI late payment penalty

One annual account statement is free but in case you misplace or don’t receive & request another statement from bank then bank might charge upto Rs 500 per statement. Legodesk is not a law firm and does not provide legal advice. The use of any materials or services or software is not a substitute for legal advice. Only a legal practitioner can provide legal advice and a legal practitioner should be consulted for any legal advice or matter. We neither endorse, nor solicit the work of any Lawyers, Law Firms, and Legal Professionals. The pledged property is endorsed at the Sub-Registrar office.

Document Retrieval Charges are the charges levied at the time of loan closure/pre-closure. It is basically a cost of transferring original documents from central document repository to the borrower. Normally all original documents received by banks are divided into 2 parts i.e. Most Important documents like Sale Deeds, Sale Agreement etc and General Documents like Khata, NOC from association etc. Most important documents are kept in safe custody at central repository and is being normally managed by 3rd parties.

hidden charges associated with home loans

However, the new bank will first look at your repayment record before approving your home loan transfer request. In case you do not have any documentary proof of the same, you have to approach your home branch to get a copy. To provide this service, the bank charges a nominal fee. For future references and use, keep copies of the original document safe with you. Memorandum of Deposit or MOD in home loan is executed between banks and borrowers for obtaining home loan.

It is essentially an undertaking given by you that you are depositing the title documents of the property with the bank at your own free will in return for a loan. For some banks, apart from the loan agreement, the undertaking needs to be registered and the government levies a stamp duty towards registration charges. Stamp duty charges vary from one state to the other, but on average, charges of 0.1 percent to 0.2 percent of the home loan amount apply.

While some banks charge a certain percentage of the home loan amount as processing fee, other banks have a flat fee for the same. The property registration process involves the seller, buyer and lender. Here, the lender will not come, rather a lawyer appointed by it will come to see through the transaction. Now, it depends whether the lawyer comes or he/she tells his/her assistant to attend the registration process. For successful registration, two eyewitnesses from the buyer and seller are also required to come to the property registrar office where the registration will be carried out. As a buyer, you need to make a few photocopies of the property registration document.

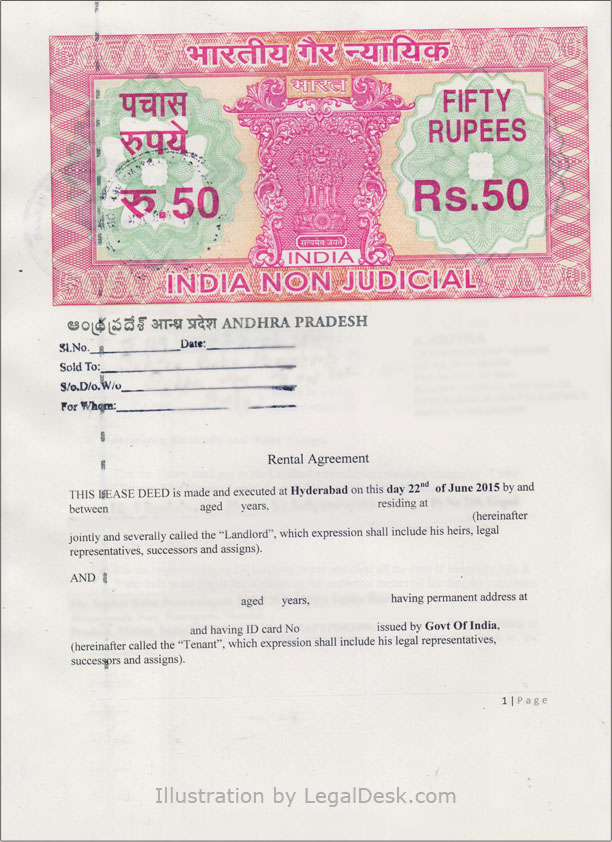

Non-judicial stamp papers that have not been used or have become spoiled can be returned for a refund. Non-judicial stamp papers, on the other hand, are only accessible up to Rs 100, and a government rule allows refunds through the challan system. Charges of stamps and registration in Telangana is payable on the higher the market value or the consideration amount in all of the instances listed below.

Besides, the government also checks the property in question – whether it is a residential property or a commercial one. It also checks whether the property is freehold or leasehold before deciding the stamp duty amount. The rate can also vary based on whether the property forms the part of a multi-storied apartment or exists as an independent unit.

Banks use the money collected as processing fee charges to verify your documents and complete various loan-related formalities. Some banks, however, offer various schemes whereby they offer zero loan processing charges for a limited period. The original sale document is submitted to the bank by the borrower, after the deed is registered at the sub-registrar’s office. This document is then sent by the bank branch to a central location, where it is kept safe through the course of the loan tenure.

The location of the sub-registrar office will be communicated through SMS once a slot is booked by online payment or by depositing challans on SBI. With the implementation of Dharani by the TRS government on September 8, 2020, all land registration operations in Telangana were placed on hold. The loan processing fee is also called a loan origination fee. This charge is levied by the bank for processing your loan application. It is a one-time charge based on the percentage of the loan amount you applied for. The most common among all Home Loan Hidden Charges is Conversion fees.

No comments:

Post a Comment